Checkout the reasons why Oil leads the world’s most important price

Whether you are in support or not, oil is still the most relevant commodity in the world. Its price can relay to us not only what’s really ongoing in the world’s economy currently, but it still retains a great influence on what could unravel in future. Right now, it is letting know that the world economy is in deep trouble.

The was worldwide trepidation last week at the shock reading of a price of barrel of US oil going for less than $40.

World oil is traded in contracts that expire on a particular day of the month. Whoever is left holding on to the contract when it expires will have to take delivery of the physical oil. Most oil traders have never and will never sight a barrel of oil, not talking of taking delivery of one.

Oil contracts are used by industrial and airlines companies to insure or manage themselves against any big swings in their fixed costs. Chronic inadequate storage facilities in the US meant that, the normal erratic contract swings on their contract expiry days became extreme, as traders became willing to pay any amount so they wouldn’t be left holding the barrels.

Demand Destruction

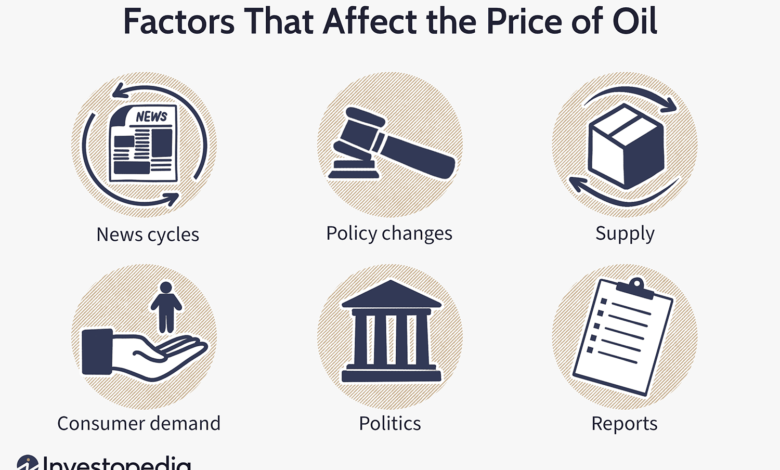

However, the basic issues behind this weird, technical and historic price anomaly is very much real. Just like any other commodity, price is driven by demand and supply. Demand for oil is a very important proxy for the global economic activity and as of now, all the talk is of ‘demand obstruction’- cities emptied of cars, factories mothballed and planes grounded.

This situation was not aided by the mere fact that an oil price war was ongoing between Russia and Saudi Arabia as COVID19 was spreading rapidly worldwide.

Since then, the major oil producers have slashed production. But such is the huge reduce in the demand, they can’t cut quick enough and the price of the global measure, Brent Crude, has continued to deteriorate, reaching a 20 year low of $16. This period last year, it was at over $70.

Is cheap oil good or bad? This question is not straightforward.

Just like sky-high oil prices can bring about recessions, low oil prices can also help recoveries. A huge fall in the oil price is just like a global tax cut on small and big businesses. If airlines can survive this and the public travelers return, they could be locked in low prices for oil.

Likewise, florists, supermarkets and haulers will all benefit from low transport costs and more cash in their customers pockets due to lower oil prices at the fuel pumps.

Bad news for savers

It is possible dirt cheap oil can help economies recover more quickly and aid in preventing a recession turning into a depression.

However, this spells bad news for savers. Major oil companies such as Shell and BP contribute between nearly a fifth of all the income UK companies generate. Bad news for them could doom their security of retirement income. These companies also pay a lot of tax.

Also there are environmental concerns. When there is cheap oil, there are less economic incentives to explore other alternatives.